Table of Contents

Market Research Report: Global Golf Apparel Industry (2024-2033)

The golf apparel industry is evolving from traditional sportswear to a high-performance, fashion-integrated market, driven by technological advancements and shifting consumer behaviors. North America leads, but Asia-Pacific shows strong growth potential. The rise of luxury golfwear collaborations signifies a broader trend toward premium, versatile sportswear.

Recommendation: Custom Golf Apparel brands should invest in tech-infused fabrics, sustainability initiatives, and lifestyle-oriented designs to capture the growing demand from both golfers and fashion-conscious consumers.

1. Market Overview

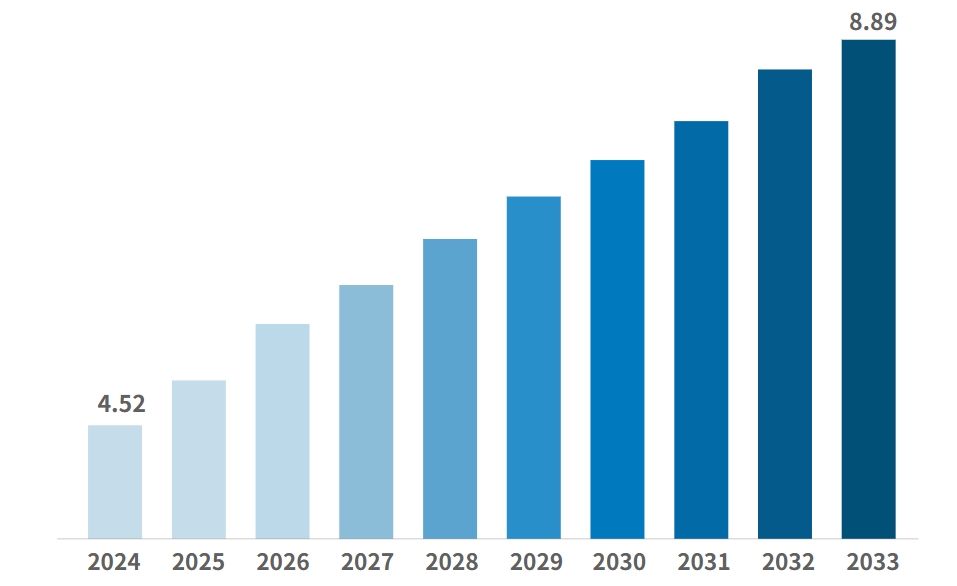

- Current Market Value (2024): $4.5 billion

- Projected Market Value (2033): $8.9 billion

- CAGR (2024-2033): 6.3%

The global golf apparel market (excluding equipment) is experiencing steady growth, driven by evolving consumer preferences, technological advancements in performance fabrics, and an expanding appeal beyond professional golfers.

2. Market Brands

The market is dominated by established sportswear brands and private label golf apparel companies, including:

- Nike Golf, Adidas, Under Armour, Puma Golf (Cobra Puma Golf) – Leading sportswear brands with strong golf apparel lines.

- Callaway, Mizuno, Ping – Performance-driven golf brands.

- Luxury & Lifestyle Brands: Ralph Lauren, PVH Corp, Perry Ellis, Greg Norman.

- Emerging & Regional Players: Fila Golf, Fairway & Greene, Oxford Golf, Straight Down, Antigua, Sunice, Amer Sports, TAIL Activewear, EP NY, and 比音勒芬 (Biynlefen) (Chinese golf apparel brand).

3. Product Trends

3.1 Shift from Traditional to Performance-Oriented Apparel

- Traditional golfwear (polo shirts, khaki pants) remains popular but is evolving with performance-enhancing features.

- Modern designs incorporate moisture-wicking fabrics, UV protection, and breathability.

- Fashion-forward golfwear appeals to both golfers and casual consumers, blurring the lines between sportswear and lifestyle fashion.

3.2 Technological Advancements in Materials

- Smart fabrics regulate temperature, enhance flexibility, and improve durability.

- Sustainability is gaining traction, with eco-friendly materials being adopted by key brands.

- Ergonomic fits and moisture management enhance comfort, influencing purchasing decisions.

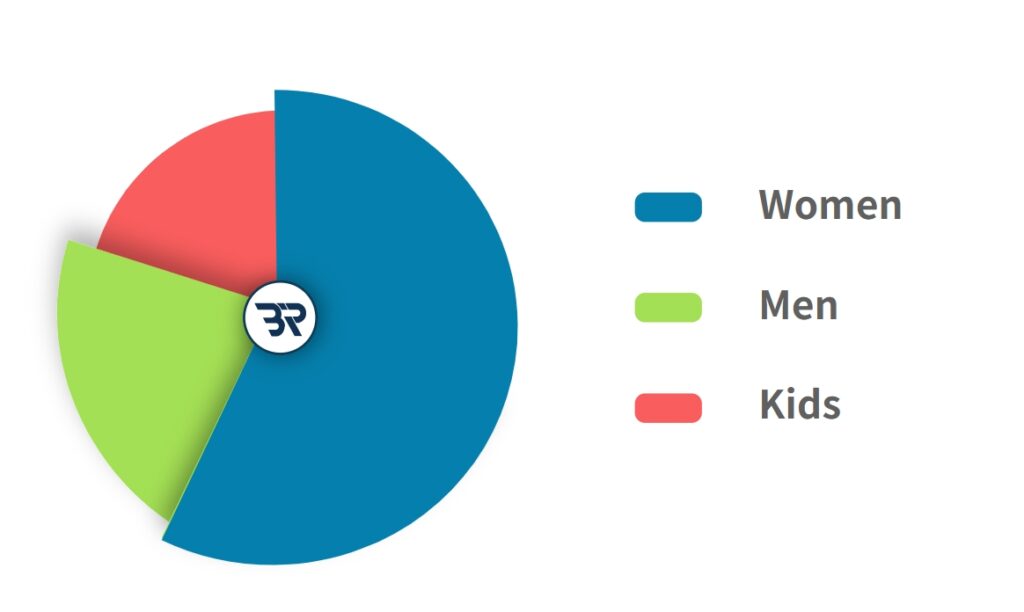

4. Consumer Segmentation

- Men: Focus on functionality and durability.

- Women: Increasing demand for stylish yet performance-driven apparel.

- Kids: Rapid growth due to rising interest in junior golf programs.

5. Regional Market Analysis

5.1 North America (Key Market Leader)

- U.S. dominance due to a large base of amateur and professional golfers.

- High-profile tournaments and celebrity endorsements drive market influence.

- Premium performance and fashion-forward golf apparel are in high demand.

5.2 Asia-Pacific (Emerging Growth Market)

- China, Japan, and South Korea show rising interest in golf.

- Lifestyle brands (e.g., 比音勒芬) are capitalizing on the premium golf segment.

5.3 Europe

- Luxury golfwear (e.g., Ralph Lauren, Adidas) performs well.

- Tourism-linked golf resorts contribute to steady demand.

6. Financial Performance & Industry Dynamics

- High-profit segment for fashion and sportswear brands due to premium pricing.

- ROI higher than other activewear categories, attracting luxury players.

- Cross-industry collaborations between golf brands (e.g., Callaway) and fashion houses.

- Capsule collections by non-golf brands (e.g., streetwear labels) are expanding the market.

7. Future Outlook (2024-2033)

- Continued growth at 6.3% CAGR, reaching $8.9 billion by 2033.

- Expansion beyond golf courses – golfwear becoming a mainstream fashion trend.

- Sustainability & tech innovation will shape future product development.

Strategic Sourcing Guide: Custom Golf Apparel Manufacturing for Bulk Wholesalers

The Rising Demand for Performance Golf Apparel

The global golf apparel market (projected to reach $7.91B by 2032) is driven by performance customization and bulk sourcing efficiency. US/AU/NZ buyers prioritize:

- Technical fabrics: UPF 50+ sun protection (AS/NZS 4399 standard) and 4-way stretch fabrics

- Size inclusivity: 40+ size matrices covering tall/athletic builds (190cm+ players = 18% untapped segment)

- MOQ flexibility: Orders from 100-5,000+ units to match boutique to big-box retail needs

1. Precision-Engineered Golf Polo Shirts

Top-tier golf polo shirt manufacturers blend performance textiles with bulk customization:

- Advanced materials: 180-240GSM cotton-pique or moisture-wicking polyester blends (65/35 poly-cotton recommended for shape retention)

- OEM-ready features:

- Eco-friendly dyeing + anti-pilling treatment

- Contrast collars & logo placement (≤2 embroidery positions free at MOQ 100) .

- Bulk advantages: 18-day production, MOQ 100 with Hong Kong tax optimization.

2. private label Golf Apparel

- Custom embroidered golf apparel

- Custom logo golf apparel as printing

3. Technical Trousers & Heated Vests: The Profit Drivers

Custom Golf Pants/Trousers

- Elastic innovations: 88% recycled polyester + 12% spandex blends for swing mobility

- Player-centric details:

- Hidden club-cleaning slots in waistbands.

- Sand-resistant pocket linings.

- Ball marker divot pockets.

Performance Golf Vests

- Heating systems: Carbon-fiber panels (-5°C/5hr runtime) vs. traditional wires

- Lightweight construction: <240g packs into self-storage pocket (NZ travel-friendly)

Why Partner with Jshine Global Golf Apparel Manufacturers?

Tax-optimized sourcing: 5-8% savings via Hong Kong offshore entity structure

Guaranteed performance: Third-party lab reports.

Rapid customization: Digital proofs in 48hr + size matrices covering XXS-5XL 39

Your Next Step: The Bulk Buyer’s Checklist

✅ Leverage MOQ 100 to test niche products (e.g., heated vests)

✅ Use DDP terms with 110% cargo insurance (Lloyd’s standards)

Ready to elevate your golf line? Request factory-direct quotes with MOQ 100 advantage.